Renewable energy in Pakistan - What you need to know

Status quo of the Pakistan energy sector

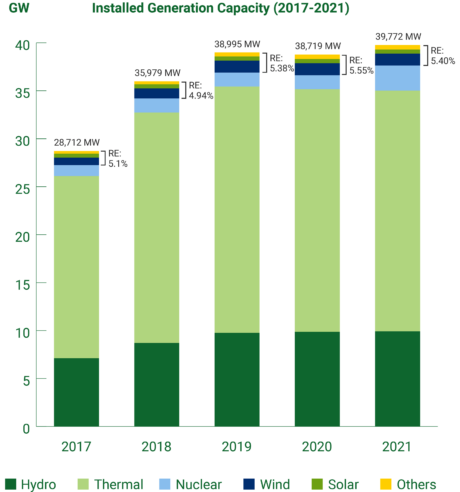

Pakistan’s energy mix is traditionally dominated by fossil fuels (gas, oil, and coal), with nearly a third of its supply coming from imports. While the country has been successful in utilising its vast potential for hydropower in the past, variable renewable energy sources so far only account for a fraction of the installed generation capacities.

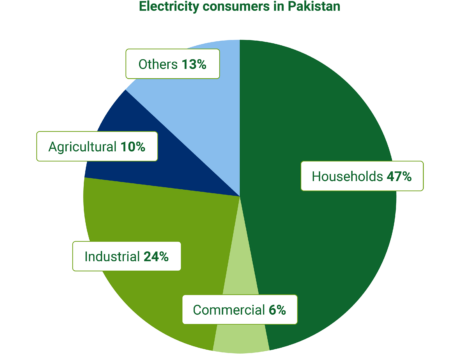

Consumers and tariffs

A country at the frontlines of climate change

Pakistan faces rates of warming considerably above the global average. Meanwhile, the frequency and intensity of extreme climate events are likely to increase, including extreme heatwaves, flooding, and the risk of droughts, all affecting human health, livelihood, and ecosystems. German Watch ranks Pakistan globally in the top 10 countries most affected by climate change, with economic losses from climate change piling up to US$ 3792.52 in the past 20 years.

Great potential for renewable energy in Pakistan

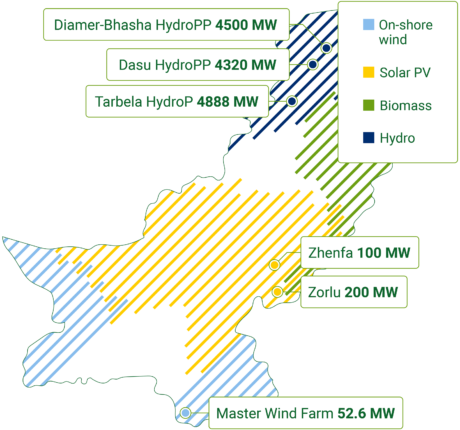

Among renewable energy sources, hydropower is the most developed in Pakistan. Small and large hydropower stations with almost 10 GW of installed capacity are currently in operation. With average horizontal irradiation varying between 1600-2200 kWh/m2, corresponding to 1400-1900 kWh/kWp per year, Pakistan harbours great potential for solar PV. However, the operational capacity is at only 430 MW in 2022, while further 250 MW are expected to be completed shortly. Meanwhile, onshore wind potentials have been identified in the southern coastal areas. The Gharo-Jhimpir wind corridor in the Sindh district already accommodates several wind farms with an operational capacity of 1,335 MW in 2022. Further technologies like offshore wind and biomass promise great potentials which have not been utilised so far.

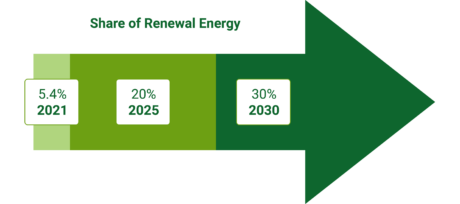

Pakistan‘s ambitious renewable energy targets

Competitive bidding for RE projects

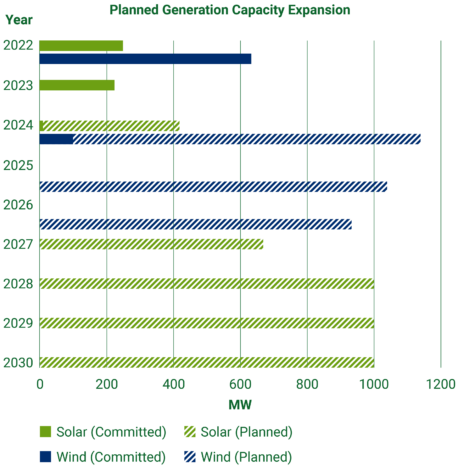

The Alternative & Renewable Energy Policy 2019 envisages the procurement of renewable energy generation capacities that are connected to the national grid through an international cost-competitive bidding process. With these auctions, the RE market is expected to become competitive, transparent, and cost-effective. Annual auctions will be conducted by the Alternative Energy Development Board (AEDB), while the tendered capacities are determined in the Indicative Generation Capacity Expansion Plan (IGCEP) by the National Transmission and Despatch Company (NTDC). The regulator (NEPRA), as well as the provincial energy departments, must approve the auction results, while NEPRA will approve the tariffs.

The transmission and distribution system

Twelve state-owned distribution companies (DISCOs) and one private investor-owned vertically integrated utility in the metropolitan area of Karachi, called K-Electric, operate the distribution system in Pakistan. Transmission is publicly owned and operated through the National Transmission and Dispatch Company (NTDC) except for the K-Electric area. Grid-related losses amounted to more than 17% in 2021, showing the devastating condition of the grids. Additional investments in grid infrastructure, including modernisation and digitalisation, will be needed to overcome the shortcomings and make the grids ready for large-scale integration of renewable energies.

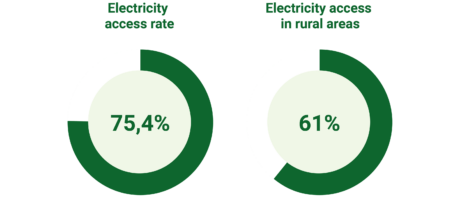

Electricity access in rural areas

As of 2020, 75% of the population in Pakistan had access to electricity, while electrification in rural areas remains lower (61%). This rate also varies per region: electrification in Federally Administered Tribal Areas (FATA), a predominantly rural area located in north-western Pakistan, amounted to 57%, while the village electrification rate is considerably higher in areas near urban centres. Mini-grids powered by micro-hydro and solar-PV already serve thousands of off-grid communities in rural regions. A novel mini-grid regulation has been enacted in 2022, granting specific regulations to mini-grids smaller than 5 MW and improving their investment conditions.

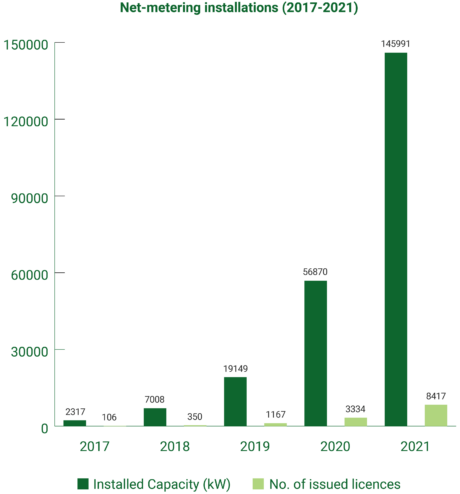

The success story of net-metering in Pakistan

2015 saw the introduction of a new regulation for distributed generation and net-metering in Pakistan, which allows any grid consumer to sell electricity back to the grid up to 1 MW, backed by a favourable tariff scheme. This opened doors for more favourable financing conditions, ultimately leading to a massive increase in installations of small PV-system up to 1 MW. Rising electricity costs and unreliable grid supply further increased the attractiveness of becoming more independent from the grid and being a prosumer.

Evolution of Pakistan‘s power market

Previously, the electricity market in Pakistan featured a single-buyer model in which the Central Power Purchase Authority (CPPA) purchased electricity on behalf of distribution companies (DISCOs). In November 2020, the regulator approved the Competitive Trading Bilateral Contract Market (CTBCM) model for opening the wholesale electricity market. This opens competition in the market as bulk power consumers (load > 1MW) can now choose to purchase electricity from the DISCOs or a competitive supplier of their choice.

Captive power generation

Most manufacturing industries in Pakistan generate their own power (captive generation) to become more independent from the unreliable power grid. Many industries, such as textile, predominantly export to the EU and USA, and thus need to respond to international emissions reduction treaties and goals. Upgrading their power generation assets to solar PV systems becomes more and more attractive, as prices for solar PV equipment are constantly decreasing, while electricity from the grid becomes more expensive. The removal of general sales tax on renewable energy products as well duty-free imports of renewable energy equipment makes investments in captive power generation more interesting.